WHAT IS A 1031 EXCHANGE AND HOW DOES IT WORK?

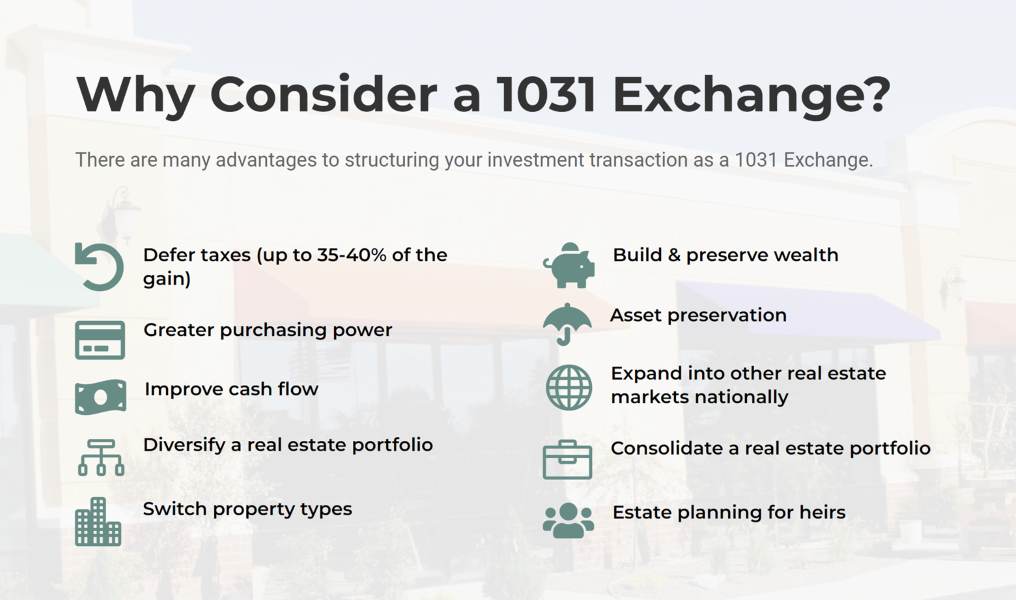

A 1031 tax-deferred exchange, named after Section 1031 of the U.S. Internal Revenue Code, is a powerful tax-deferment strategy popular with experienced real estate investors. Also known as a like-kind exchange, it is used by investors to defer capital gains taxes from a property when it is sold - as long as the investor purchases another like-kind property with the proceeds of the first property sale. The term “like-kind” refers to the nature or character of the property, not its grade or quality. Essentially, there’s a wide variety of property types that you could consider to be like-kind. As long as the net market value of each successive property rises (or combined net market value, in the case of multiple replacement properties), you can exchange into like-kind properties indefinitely.

In other words, you take the taxes you would normally pay to the government on your profits and continue to reinvest these government tax monies to make even more money, postponing the payment of taxes to some date of your choosing in the future. This process is one of the greatest investment tools ever devised and can be repeated over and over again to create a legacy of wealth. The principals at Lifestyles have successfully used this system as their own wealth building strategy, multiplying a few properties into 50+ properties. At Lifestyles, our mission is to educate and empower investors to achieve their financial freedom by investing in real estate.

EXAMPLE OF A 1031 EXCHANGE

Consider an investor who owns an apartment building valued at $1 million. The investor has held this rental property for several years and has accumulated substantial appreciation, making the building worth more now than when they initially purchased it. Now, the investor wants to diversify their portfolio, and they’re eyeing a commercial retail space in Boston worth $1.5 million.

The investor decides to utilize the 1031 exchange. They sell the apartment building and use the proceeds to acquire the retail space in Boston. By using the 1031 exchange, they can defer paying capital gains tax on the sale of the apartment building. Despite changing their investment from residential real estate to commercial property, this transaction qualifies as a like-kind exchange because it involves similar types of assets (real estate). The net market value increases from one property to the next. Hence, the 1031 exchange allows the investor to seamlessly shift their real estate investment while postponing tax liabilities.

1031 EXCHANGE REQUIREMENTS

The 1031 exchange, while advantageous, is bound by stringent regulations set forth by the IRS. To qualify for this tax-deferral strategy, you must meet specific criteria and follow certain rules. Failure to follow these requirements can result in the disqualification of the 1031 exchange, leading to potential capital gains tax liability.

As an investor, you’ll want to familiarize yourself with these 1031 exchange requirements:

- Like-kind property. The properties involved in the exchange must qualify as like-kind. This doesn’t necessarily mean they must be of the same type (e.g., apartment for apartment), grade or quality. Instead, it implies a broad range of real estate qualifies, as long as it’s held for productive use in a trade, business or investment.

- Investment or business property only. Personal residences don’t qualify for a 1031 exchange. The subject properties must be held for investment or used in a trade or business.

- Greater or equal value. To fully avoid paying any tax, the net market value and equity of the property acquired must be the same as, or greater than, the property sold.

- Same taxpayer. The tax return and name appearing on the title of the property being sold must be the same as the tax return and title holder that buys the new property.

- Must not receive “boot.” The term “boot” refers to any additional value received in an exchange that isn’t like-kind property, such as cash, property improvements or debt relief.

- Reinvest all equity. When you sell a property as part of a 1031 exchange, all of the equity you receive from the sold property must be reinvested into the replacement property. If you pull equity out in the course of the replacement, you may be liable for taxes on the portion that isn’t reinvested.

- Arm’s length transactions only. When you sell and buy property as part of a 1031, both the sale and purchase need to be arm’s length transactions. This means you can’t engage in transactions with family members or other parties you have a personal or close relationship with as part of the exchange.

Each of these requirements plays a crucial role in determining the validity of a 1031 exchange. Hence, you must be diligent and careful in fulfilling these stipulations to capitalize on the exchange’s tax-deferment benefits.

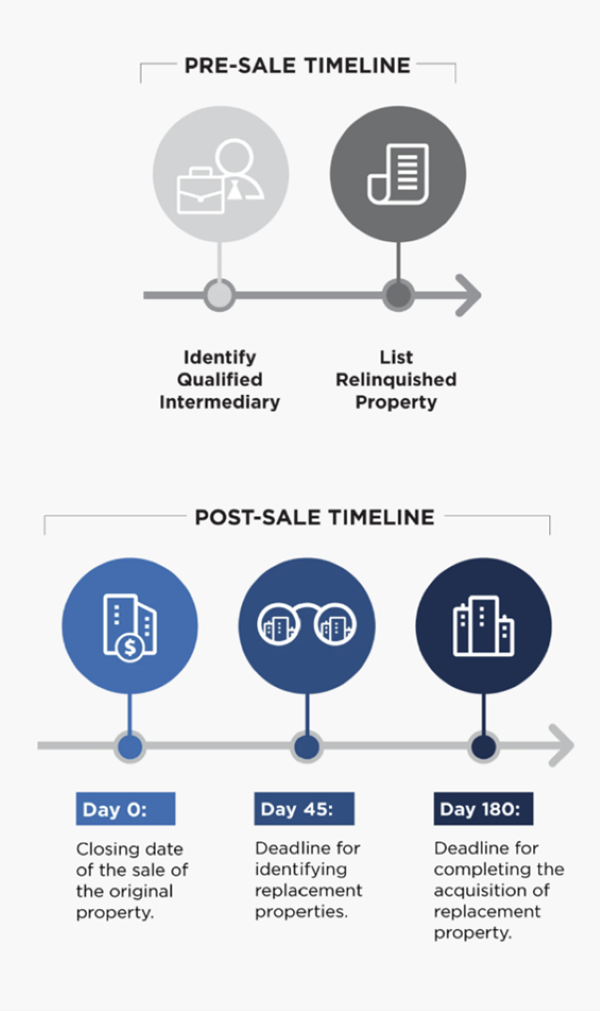

1031 Exchange Timelines and Rules

The 1031 exchange process involves strict timelines and rules that must be followed to successfully defer capital gains tax. Below are some essential points to keep in mind regarding these timelines and rules:

- 45-day identification period. This is the first significant timeline in a 1031 exchange. Within 45 days of selling the relinquished property, you must identify potential replacement properties. This includes providing a written list of up to three properties, regardless of their value, or an unlimited number of properties as long as the total value doesn’t exceed 200% of the sold property’s value.

- 180-day purchase period. The second significant timeline begins on the day you sell your property and lasts for 180 days. During this period, you must close on one or more of the properties identified in the previous step.

- No personal use allowed. You must hold the replacement property acquired through a 1031 exchange for productive use in a trade, business or investment. Personal residences don’t qualify.

- Full reinvestment required to defer all taxes. To fully defer capital gains tax, you must reinvest all proceeds from the sale of the relinquished property into the purchase of the new property.

- Reverse 1031s are possible. In some cases, it may be possible to purchase your replacement property before selling the property you intend to replace. This is called a reverse 1031 exchange and shares many of the same rules and requirements as a normal exchange.

By adhering to these timelines and rules, you can successfully complete a 1031 exchange and defer capital gains tax on your investment property. Still, it’s always advisable to consult with a tax professional or qualified intermediary for guidance throughout the process.

HOW TO DO A 1031 EXCHANGE

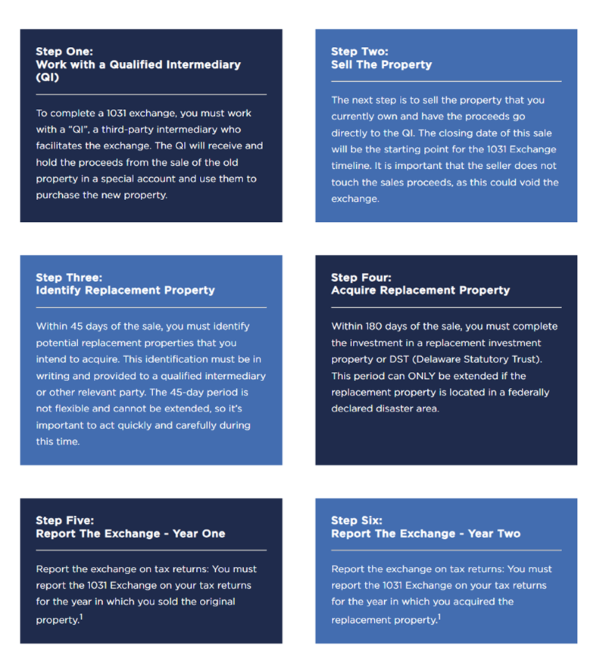

Conducting a 1031 exchange may seem daunting due to the complex rules and procedures involved. However, with a clear understanding and a systematic approach, it can be a smooth process.

Follow these steps to do a 1031 exchange:

- Identify the property you want to sell. This must be an investment property—not a primary residence—and it should ideally have appreciated in value since you purchased it to take full advantage of the tax deferment benefits of a 1031 exchange.

- Engage a qualified intermediary. Before you sell your property, hire a qualified intermediary (QI). This is a mandatory step because the IRS doesn’t allow the seller (you) to touch the money between the sale and the purchase of the new property. The QI holds the funds during this period.

- List your property for sale. Once it sells, the proceeds (minus any costs, including debt payoff) go to the QI. The proceeds should not go to you or your bank account; otherwise, you’ll lose the 1031 exchange opportunity.

- Identify potential replacement properties. You have 45 days from the date of sale to identify up to three potential replacement properties—regardless of their total value—or as many properties as you want, as long as their combined value doesn’t exceed 200% of the sold property’s value. You must record this in writing and deliver it to the QI.

- Purchase the replacement property. From the date of sale of your initial property, you have 180 days to complete the purchase of any property or properties identified in the previous step. The QI then transfers the funds from the initial sale to the seller of the replacement property.

- File Form 8824 with your taxes. When you file your taxes for the year the exchange took place, include Form 8824 in your tax return, notifying the IRS of the exchange and informing them what property you sold and what property you purchased as part of the exchange.

The IRS rules for 1031 exchanges are strict, so follow them closely. If done correctly, a 1031 exchange can be a powerful tool for building wealth through real estate investment.

WHAT IS THE PROCESS WHEN INVESTING IN A 1031 EXCHANGE?

KEY CONSIDERATIONS WHEN INVESTING IN A 1031 EXCHANGE

Be Proactive: The rules for a 1031 exchange are very specific, from the timeline to identify a replacement property to the type of eligible property, understanding how the calculations work and more. We recommend being proactive and well aware of all property and sale timelines, by engaging with a Qualified Intermediary and speaking with your tax consultant. This is important because every person’s situation is different and it may be more profitable to pay taxes now versus deferring until later.

Details matter: Work closely with your advisors to ensure you don’t trip yourself up. For example, pay close attention to withdrawals as these can be considered taxable, understand the role of “boot” and know the level of leverages on the replacement property to avoid negative surprises.

Focus on your goals: Tax deferral is important but make sure you are achieving your financial goals with the transaction and not just focused on the tax bill. Real estate investments do not come without risk and typically are illiquid (meaning “not being cash or readily convertible into cash investments”)…so make sure that a 1031 exchange is right for you.

COULD THIS BE THE INVESTMENT VEHICLE FOR YOU?

Lifestyles is well suited to represent investors in their 1031 Exchange transactions. Not only do we have experience handling the purchase and sale of exchange properties for clients, we have personal experience in participating in the exchange of over 50 of our own properties. Aside from experience, our company is uniquely positioned to buy and sell 1031 exchange properties because of our redesign of the outdated traditional buying and selling systems used by the majority of Real Estate companies in the industry.

In addition to the better strategies and methodologies we use, we have created three distinct platforms for the purchase and sale of properties: The Lifestyles Advantage Program, the Off Market Marketplace, and the Homeowners Investors Portal. The 1031 Exchange process is an unforgiving process that has to be followed to the “T” in order to avoid being disqualified and incurring severe financial penalties. Our proprietary systems and unique performance guarantees assure clients that we can maximize results while still meeting the required guidelines and time frames.

"

"